Post-Fourth Optimism for American Housing Market

There haven’t been a lot of positives to write about regarding the housing market over the past few months (or more). Rates have pushed toward 7%, home values have ebbed and flowed, inventory has been especially low, overall sales have lagged, and on top of that, the economy has been less than stellar. Add it all up and you’re left with a heaping dose of volatility within the market and rampant uncertainty among buyers and sellers. But there is light in the not-so-distant tunnel. The residential market appears to be rebounding, with a resurgence of buyer interest, small improvements in supply, and the stabilization of home prices.

_____

Let’s Dive Deeper

Resurgence in Buyer Demand

That’s right. Buyer demand in the real estate market is surging, with a Freddie Mac survey indicating that about 18% of Americans intend to buy a home within the next six months. Particularly noteworthy is the fact this is a significant increase from the pre-pandemic average of 8%-10%. According to the latest surveys, 16% of homeowners plan to sell their properties within this period. While mortgage rates seem to be hovering between 6% and 7%, sales figures continue to rise steadily, especially in the middle-income bracket of $250,000 to $500,000. Granted, supply constraints persist, with inventory levels around half of what it was in 2019.

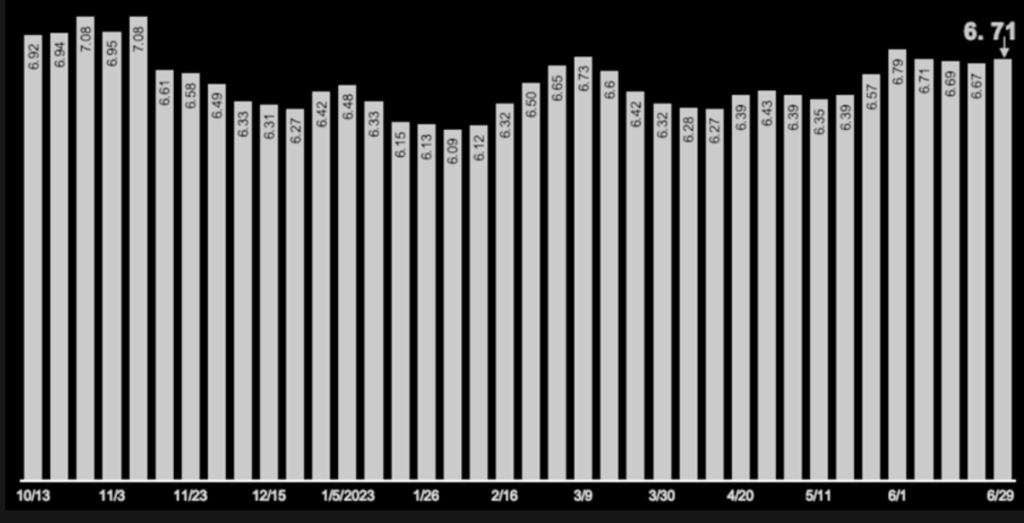

The New Normal: Mortgage Rates in 6% – 7% Range

30-Year Fixed Rate | October 2022 – Today

Source: Freddie Mac

Source: Freddie Mac

Housing Supply Is Improving

Although housing supply is hardly abundant, it is nevertheless improving, with the number of homes for sale rising by 7.1% compared to last year. Active listings in 2023 significantly exceed those for the past two years, offering buyers a wider choice of homes, as well as more time for consideration. The desperation to buy “sight unseen” to beat would-be competitors is in the past. Mind you, we are not approaching pre-pandemic supply levels, just to be clear. New listings declined by 25.7% in June compared to last year and are almost 28% below pre-pandemic levels. While homeowner confidence is by no means great, new listings should creep up more and more in the coming weeks.

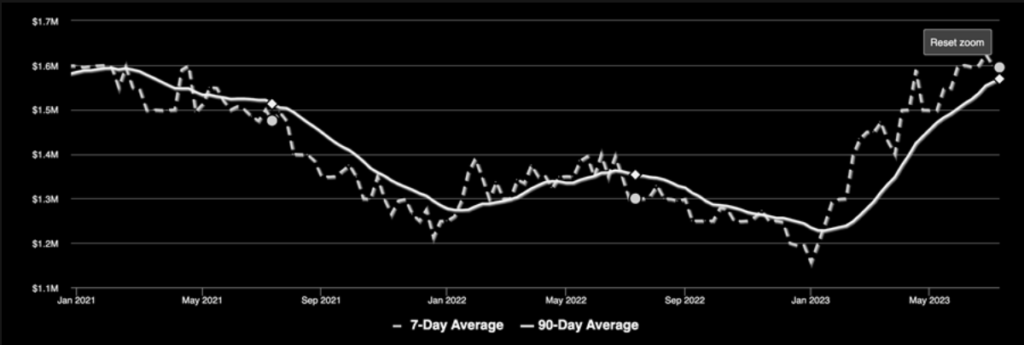

Home Prices Are Rebounding

This is big. Home prices have rebounded, challenging the fall 2022 predictions of a steep market correction. Altos Research’s listing prices reveal a distinct seasonal pattern of rising prices in spring and summer and declines in fall and winter, a pattern that seems to be returning. Los Angeles median list prices (as of July) are equivalent to the February 2021 median of $1.6M. A look at indices like the Case-Shiller, the Federal Housing Finance Agency index, and CoreLogic index, shows a market rebound in 2023, with prices climbing per usual yearly trends. This all bodes well as consumer confidence is finally on the rise.

Los Angeles, CA

Median List Price | January 2021 – Today

Source: Altos Research, Inc.

Source: Altos Research, Inc.

_____

IN PLAIN BLACK & WHITE

What Buyers Need to Know

- Despite a competitive market due to limited supply, there are numerous housing options and steady prices.

What Sellers Need to Know

- The high buyer interest favors sellers. However, they should consider the impact of elevated mortgage rates on buyer affordability.

What Investors Need to Know

- The rising demand, limited supply, and steady prices present potential investment opportunities, especially in areas with increased listings.