End of Summer Brings New Opportunities – And Challenges

As school begins across the country, let’s take a quick and educational look back at what the residential market has been through…and where it may be heading. At the risk of sounding pedantic, I will begin this lecture by extolling the patience of both buyers and sellers over the past 10 to 12 months. Rates stayed up around 6.5 – 7% and inventory continues to be low as buyers have been wary, yet persistent. Some sellers, however, are caught in the proverbial “golden handcuffs”: they are unwilling to sell now and give up the 3-4% rates they’ve been enjoying only to purchase a new home at a much higher rate. Not surprisingly, this has led to a lack of inventory, as well.

_____

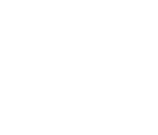

2022 Market Recap

The year began with home prices surging at an extraordinary rate. Rapid appreciation led to a correction as the year progressed, bringing about more balanced pricing toward year-end.

Adjustments in 2023

The home price trend suggests a return to normal appreciation rates after below-average figures in the initial months of the year. Things normalized in recent months as major price indices, such as Case-Shiller, FHFA, and CoreLogic, have indicated.

_____

Percent Change in Home Values

Month-Over-Month

_____

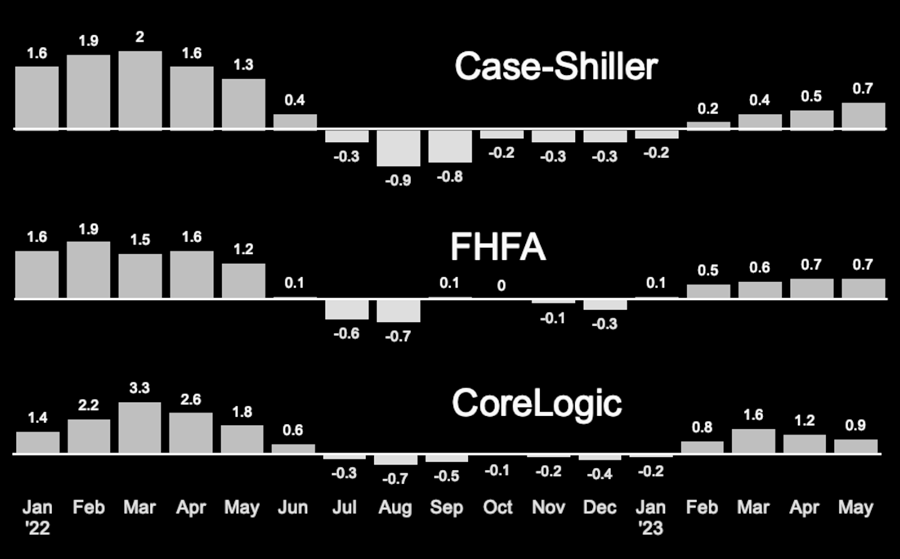

2023 Year-End Home Price Forecasts

12/2022 vs Current Forecast

_____

Last Opportunity for Buyers is Now

With so much inventory sitting and a lack of competition for what is currently available, buyers have some real opportunities if they are smart. After all, the difference between a good deal and bad deal can vary from neighborhood to neighborhood so it’s important to work with an agent who understands the dynamics of the market and how it can dip depending upon location. A house on one block may be a great value whereas a block over a similar style home may be a risk. But for the savvy and well-informed buyer, inventory that has been on the market for a while—and has an antsy seller “hoping and praying” for a buyer—is the perfect chance to write an aggressive offer at the terms you want.

_____

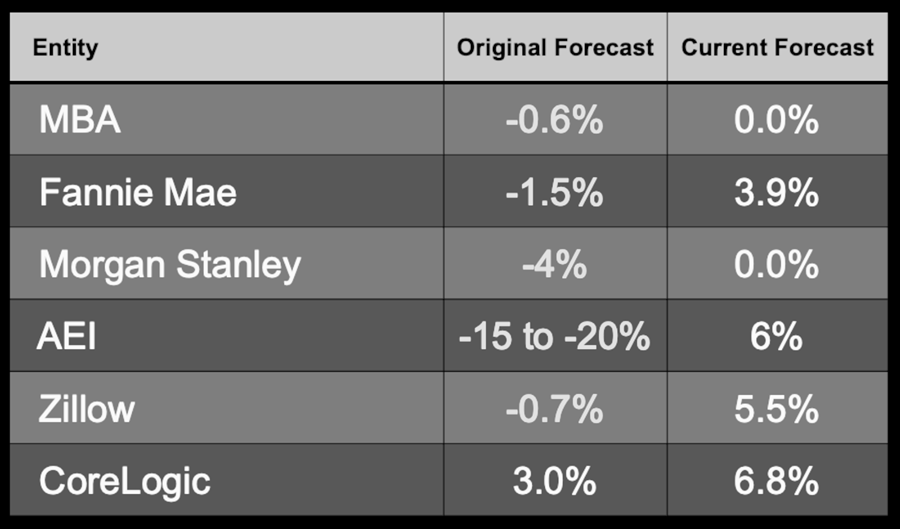

What’s Coming in Q4…and Beyond?

When someone asks me: “How’s the market?” The truth is, there isn’t a one-size-fits-all answer. The market’s state depends on whether you’re looking to buy, sell, or invest. Beyond that, it’s about the specific Los Angeles neighborhood you may be considering, as well as your targeted price range. Although no one knows for sure, there are specific indicators that predict a decrease in rates in the coming months and a return to normalization. Only, it won’t be normal…it could very likely be a cluster as sellers scramble to list homes they’ve been sitting on, and buyers come out of the woodwork to scoop up the new “rate-friendly” inventory.

_____

Mortgage Rate Projections

August 2023

_____

IN PLAIN BLACK & WHITE

What Buyers Need to Know

- Inventory shortage might make property hunting more competitive.

- Mortgage rate fluctuations indicate a potential benefit from waiting or acting swiftly, depending on your specific situation.

- City-specific trends necessitate localized research before buying.

- Now seems to be a good time to buy—whereas Q1 & Q2 may not be, if rates go down to 5ish and competitive chaos ensues.

What Sellers Need to Know

- The continued inventory shortage might present an excellent opportunity for a profitable sale.

- With potential mortgage rate changes, assessing buyer sentiments and flexibility in the market is crucial. Stay alert and informed!

What Investors Need to Know

- Localized price appreciation trends will guide investment decisions.

- Inventory shortages might mean higher rental demand.

- Stay informed about mortgage rates, as they significantly impact property financing decisions.